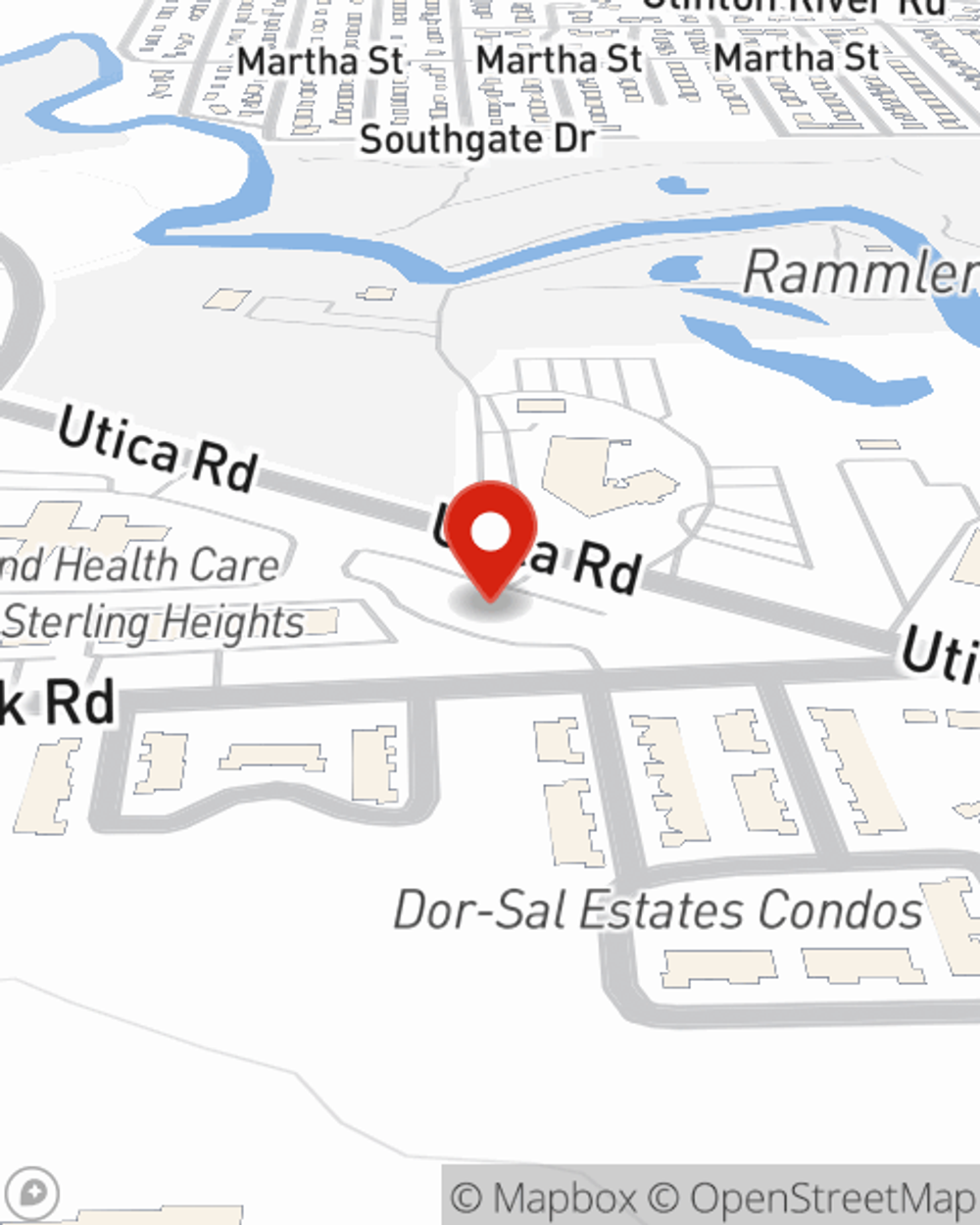

Business Insurance in and around Sterling Heights

Get your Sterling Heights business covered, right here!

Helping insure businesses can be the neighborly thing to do

Coverage With State Farm Can Help Your Small Business.

As a small business owner, you understand that running a business can be risky. Unfortunately, sometimes mishaps like a customer stumbling and falling can happen on your business's property.

Get your Sterling Heights business covered, right here!

Helping insure businesses can be the neighborly thing to do

Insurance Designed For Small Business

With State Farm small business insurance, you can give yourself more protection! State Farm agent Steve Smith is ready to help you prepare for potential mishaps with reliable coverage for all your business insurance needs. Such attentive service is what sets State Farm apart from other business insurance providers. And it won’t stop once your policy is signed. If the unexpected happens, Steve Smith can help you file your claim. Keep your business protected and growing strong with State Farm!

Take the next step of preparation and reach out to State Farm agent Steve Smith's team. They're happy to help you research the options that may be right for you and your small business!

Simple Insights®

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

Steve Smith

State Farm® Insurance AgentSimple Insights®

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.